Every January 1, we make resolutions to better ourselves. Setting a goal is easy, but sometimes achieving the goal seems impossible. Here are some small financial tips that might help you along the way:

Don’t buy coffee, make it yourself – Purchasing one medium coffee a day can cost you upwards of $730 a year. Is your goal this year to take a trip to Aruba? By making your own coffee, that $730 can be used to swim with dolphins instead (at your all-inclusive resort of course!).

Cancel your gym membership and use the College’s gym for free – Even the most basic membership can cost as much as $120 a year. By using the College’s gym for free, you can spend the $120 and meet your goal to see a show on Broadway instead.

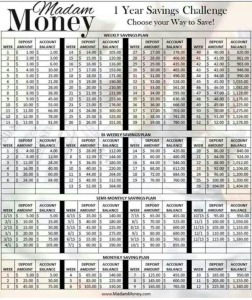

Do the 52 week savings plan – The 52 week savings plan will result in you putting aside $1,378 by the end of the year. Are you hoping to buy a new car this year? Use the money saved toward your first down payment.

Use the Dave Ramsey “Snowball Plan” while paying down debt – Is your goal to pay down your credit card or student loan debt this year? His plan is very simple to follow: pay minimum payments on all of your debts except for the smallest one. Every extra dollar you have should be allocated to pay that smallest debt until it is gone. Once it’s paid off, you add its old minimum payment to your next debt payments. So, as the snowball rolls over, it picks up more snow.

Get it? For more budgeting tips, stop by our office. We’re always here to help!